HT Team to update

HT Team to update

HT Team to update

Revenue is one of the most important financial statement measures to both users and preparers of financial statements and is often used by investors and regulators as a measuring stick of financial health.

However, previous revenue recognition guidance and disclosures were often criticized for being overly complex and for not providing the level of detail users required. As a response, the Financial Accounting Standards Board (FASB) issued its landmark standard, Revenue from Contracts with Customers, in 2014 which sets out a single and comprehensive framework for how much revenue is to be recognized, and when.

The new standard takes effect in 2018 for public companies and in 2019 for all other companies, and addresses virtually all industries in U.S. GAAP, including those that previously followed industry-specific guidance such as the real estate, construction and software industries. For many entities, the timing and pattern of revenue recognition will change. In some areas, the changes will be very significant and will require careful planning.

The new standard also introduces an overall financial statement disclosure objective together with significantly enhanced disclosure requirements for revenue recognition. In practice, even if the timing and pattern of revenue recognition does not change, it is possible that new and/or modified processes will be needed in order to comply with the expanded disclosure requirements.

Identify the Contract

Identify separate performance obligations

Determine the transaction price

Allocate the transaction price to performance obligations

Recognize revenue as or when each performance obligation is satisfied

Each of these five steps described above requires a host of key judgments and decisions and HoganTaylor’s Revenue Recognition Implementation Team has the experience and knowledge to guide entities through the entire five step assessment process. Additionally, HoganTaylor has experienced professionals who are able to assist with necessary changes resulting from adoption of the new standard such as changes in internal controls, IT systems, compensation and benefits, sales agreements, or debt covenants.

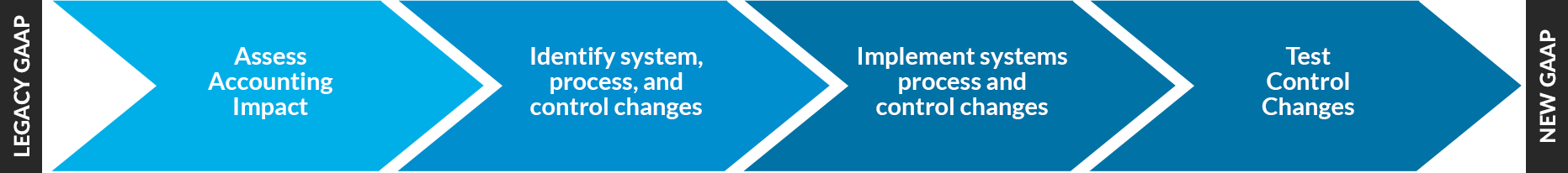

To address the challenges presented by the new standard, entities will want to consider their overall implementation approach and the impact to the entire organization.

Hogan Taylor Can Help

- Assess impact of significant revenue streams

- Identify implementation issues

- Evaluate transition methods

- Develop action plans and milestones

- Assess disclosure requirements

- Assess IT systems

- Assess internal controls and develop new processes

- Perform cross-functional analysis of impact to other contracts (e.g. sales, comp and benefits, debt)

- Provide technical accounting resource support

- Update process and control documentation

- Train personnel

- Document new controls

- Draft footnotes and disclosures

- Test changes to financial reporting system

- Test manual controls

- Provide loaned staff professionals